AI's Real Impact on Software Launches: Evidence from Product Hunt

The debate around AI and SaaS tends to split into two camps.

On one side is the Replacement Theory: AI is an “extinction event” for traditional SaaS.

On the other is the Acceleration Theory: AI is a force multiplier that makes shipping software dramatically easier.

Instead of anecdotes, I analyzed 267k Product Hunt launches (Jan 2020 → Jan 2026)—Product Hunt being the go-to platform where makers showcase new tech products to early adopters—and classified each as AI vs non-AI based on transparent keyword rules. Then I tracked launch volume, AI share, growth rates, and “AI pivots” (products relaunching with AI positioning).

I retrieved the name, description, and launch date for each product, removed spam using regex/pattern heuristics + NLP spam detection (then manually curated the results via whitelist/blacklist files), flagged AI-related launches using transparent keyword rules, and then tracked:

- how AI’s share of launches changed over time,

- how overall launch volume moved,

- and whether AI launches are growing faster than non-AI launches.

Important: “AI-related” here means AI positioning in the name/description, not verified implementation.

TL;DR:

- AI’s presence in launches exploded ~6.5× post-ChatGPT (avg 4.92% → 31.75%), reaching ~40% in late 2025.

- Acceleration is the dominant macro-trend: in the latest-month YoY comparison (2026-01 vs 2025-01), total launch volume is up +139%, while AI-specific launches are up +167%.

- AI pivoting is real: 2,027 products relaunched with AI positioning; median pivot time: 11.5 months.

- Normalization signal: recent non-AI MoM growth is ~1.2pp higher (3-month rolling avg), hinting at a “post-AI” baseline.

- The big picture: Software is being commoditized—AI made building dramatically easier, flooding the market. We’re entering a “post-AI” era where the technology is assumed, not advertised.

The big story: AI grew fast, but so did everything else.

(Full methodology at the end for those who want to audit the approach.)

Metric definitions used in this report

- Latest-month YoY: compares one month to the same month one year earlier (e.g., 2026-01 vs 2025-01).

- Trailing-12 YoY: compares the sum of the last 12 months to the prior 12 months.

- Median monthly YoY (last 12 months): median of 12 monthly YoY values, which is less sensitive to spikes.

- Unless stated otherwise, headline YoY figures refer to latest-month YoY.

Index

- Product Hunt Launches Over Time (AI vs Non-AI)

- AI in Product Names (Branding)

- Month-over-Month Growth (Momentum)

- AI Pivots: Legacy Products Relaunching with AI Positioning

- AI Buzzwords vs Substantive Mentions (AI-washing)

- AI Normalization: When “AI” Stops Being a Differentiator

- Interpreting the Results

- Caveats

- Methodology

- Conclusion

Product Hunt Launches Over Time (AI vs Non-AI)

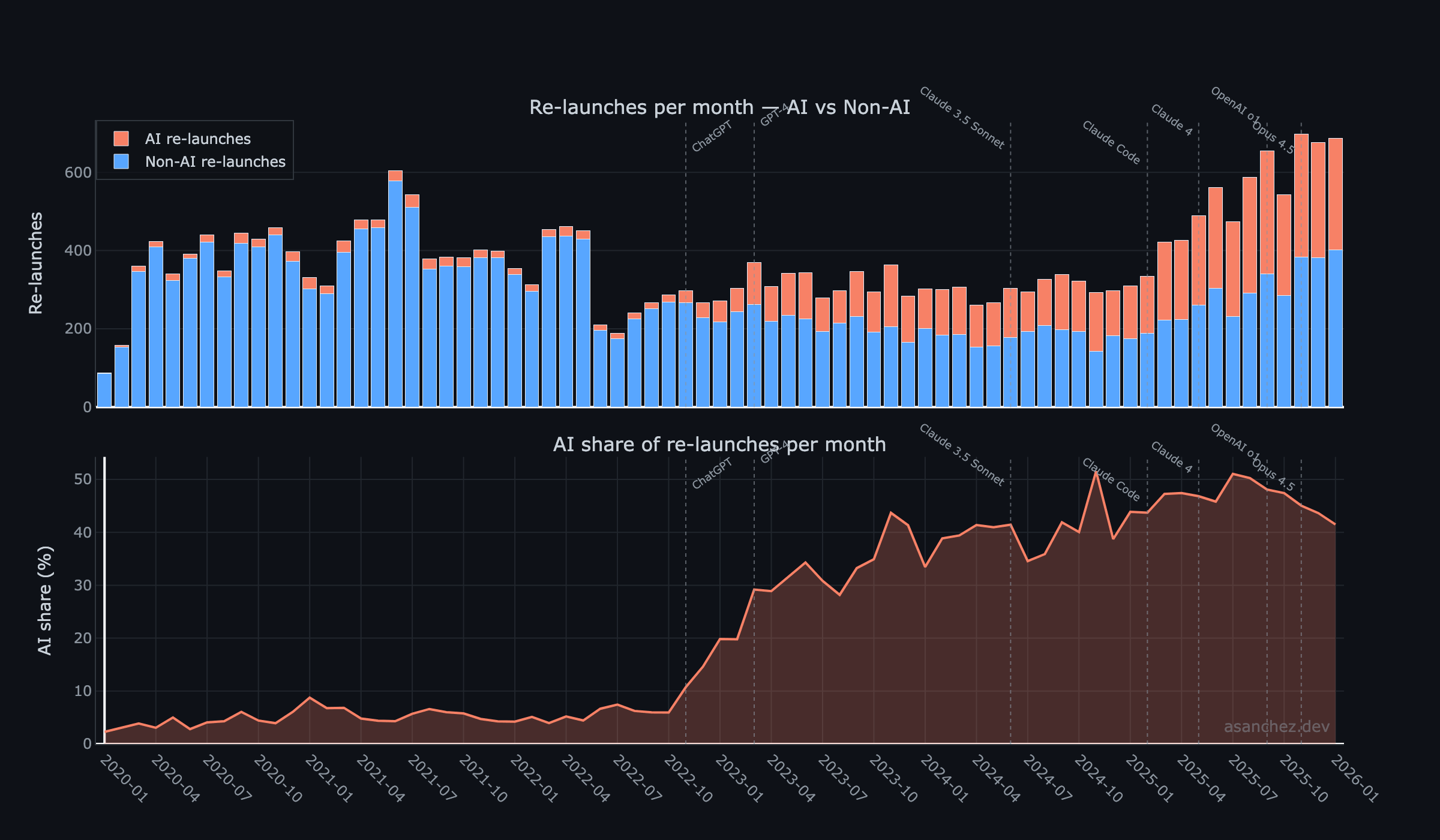

With every launch labeled as AI or non-AI, the simplest question becomes:

How did the mix change over time?

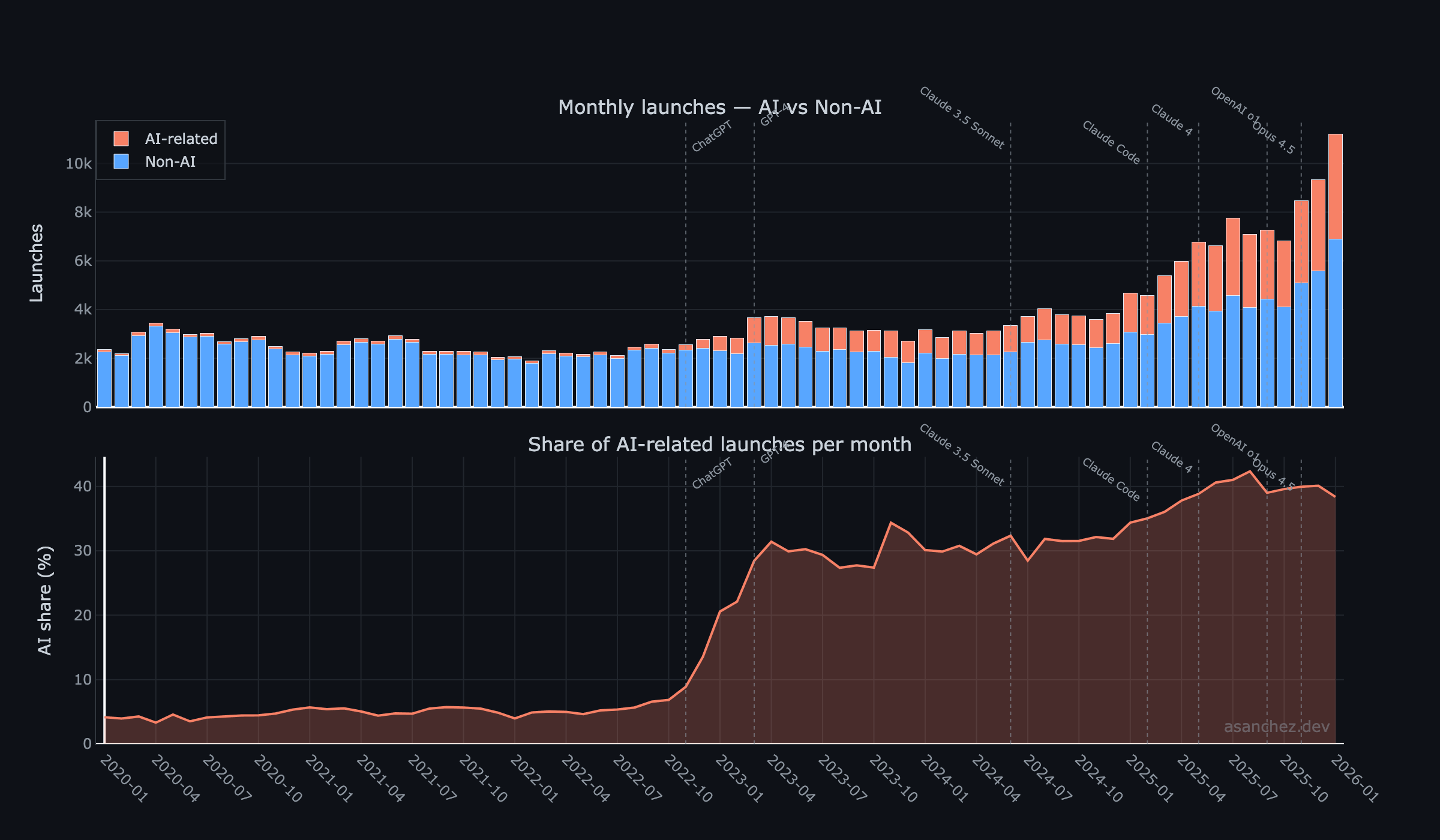

Here’s the monthly time series (2020-01 → 2026-01):

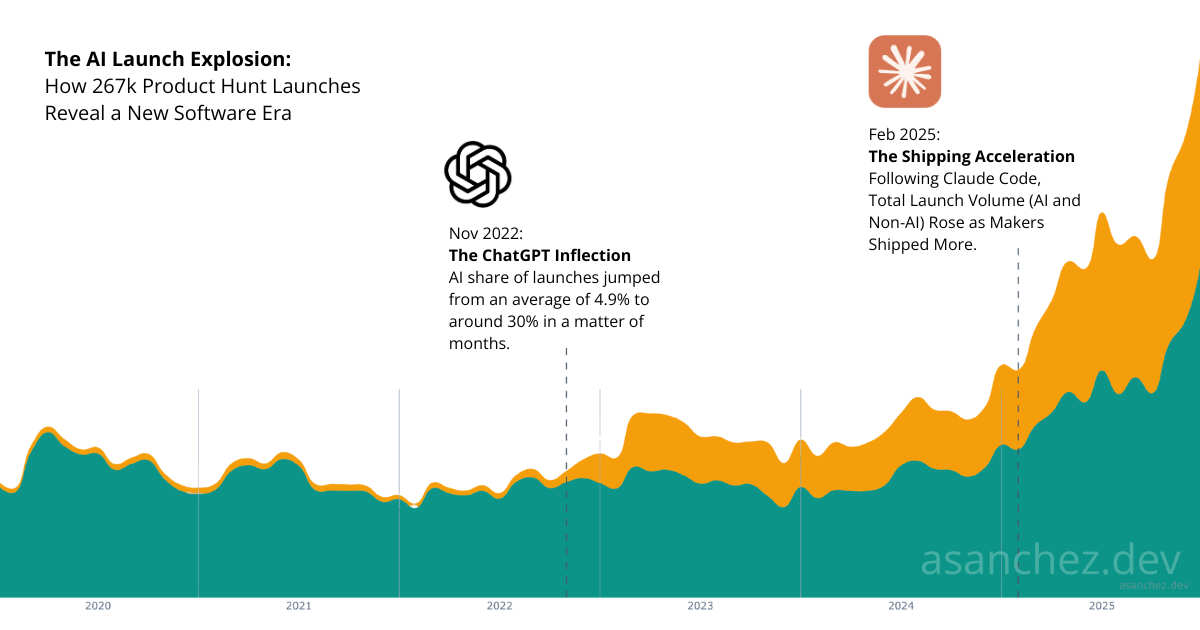

AI moved from a low single-digit share in 2020-2022 to ~30-40% after the ChatGPT era. But total launches also climbed. The whole curve lifted, which could signal either a healthy ecosystem or a crowded one.

To put this in perspective: before the launch of ChatGPT, product launches detected as AI averaged just 4.92% of all launches. After November 2022, this percentage jumped to an average of 31.75%, a ~6.5x increase. In the last months of 2025, AI launches approached 40% of all products shipped on the platform.

| Year | Total Launches | AI Launches | AI Share | YoY Growth | AI YoY Growth |

|---|---|---|---|---|---|

| 2020 | 33,437 | 1,416 | 4.2% | — | — |

| 2021 | 29,579 | 1,540 | 5.2% | -11.5% | +8.8% |

| 2022 | 27,787 | 1,809 | 6.5% | -6.1% | +17.5% |

| 2023 | 38,919 | 11,135 | 28.6% | +40.1% | +515.5% |

| 2024 | 41,380 | 12,816 | 31.0% | +6.3% | +15.1% |

| 2025 | 80,791 | 31,590 | 39.1% | +95.2% | +146.5% |

Three distinct explosions

The chart includes milestone markers (ChatGPT, Claude Code, Opus 4.5, etc.), which makes it easier to anchor the inflection points. Looking at the time series, we can identify three distinct explosions in launch activity that closely follow major model/tool milestones:

ChatGPT (Nov 2022) → early 2023: the first and most dramatic jump in AI-positioned launches, immediately after ChatGPT reached the mainstream.

Claude Code (Feb 2025) → mid 2025: a second acceleration where total launches rise (AI and non-AI), consistent with makers shipping more overall.

Opus 4.5 (Nov 2025) → Dec 2025 / Jan 2026: a third step-change in total launch volume, with AI and non-AI both accelerating.

Each wave tells a different story: the first is mostly about building AI products (or at least marketing as AI), while the latter two are mostly about building with AI (more shipping across the board). The timing lines up with major releases. That’s not proof of causality, but it’s consistent with “AI made shipping easier,” not just “people marketed as AI.”

Late 2025 → Jan 2026 surge (and the October correction)

With the corrected data, October 2025 is no longer a phantom spike month. It’s a mild pullback (6,811 total launches; -6.3% MoM). The real surge begins right after:

- November 2025: +24.4% MoM total (AI +25.6%, non-AI +23.7%)

- January 2026: +20.1% MoM total (AI +14.8%, non-AI +23.5%)

The timing lines up with the November 2025 “Opus 4.5” marker in the milestone timeline, but it could also be driven by Product Hunt dynamics (SEO, moderation, incentives, growth). Treat it as correlation, not proof.

Vibe coding: real but tiny

Despite the discourse, explicit “vibe coding” mentions remain niche. Only 245 launches have referenced the term since it emerged in February 2025. Peak was 37 launches in January 2026, just 0.33% of all launches that month. The concept is accelerating, but it’s far from mainstream in how products position themselves.

What this shows (from the monthly data)

- AI-related launches are now 38.4% of all launches (latest month), up from 34.4% a year ago. (Note: the cumulative share across all 6 years is 24.6%, but the monthly share has grown significantly over time.)

- Latest-month YoY (2026-01 vs 2025-01): AI launches +167%, total launches +139%.

- Robustness check (last 12 months): median monthly YoY is +151% for AI and +98% for total; excluding 2025-12 and 2026-01, medians remain high at +144% (AI) and +95% (total).

- Peak AI share: 42.3% in 2025-08.

- Latest month (2026-01): 11,195 total launches, 4,295 AI-related.

That’s the key tension: On one hand, non-AI launches didn’t collapse; they grew. On the other hand, this surge in launches could support the commoditization thesis: if anyone can ship software now, the market floods with competitors, driving prices down. More products doesn’t mean more revenue per product.

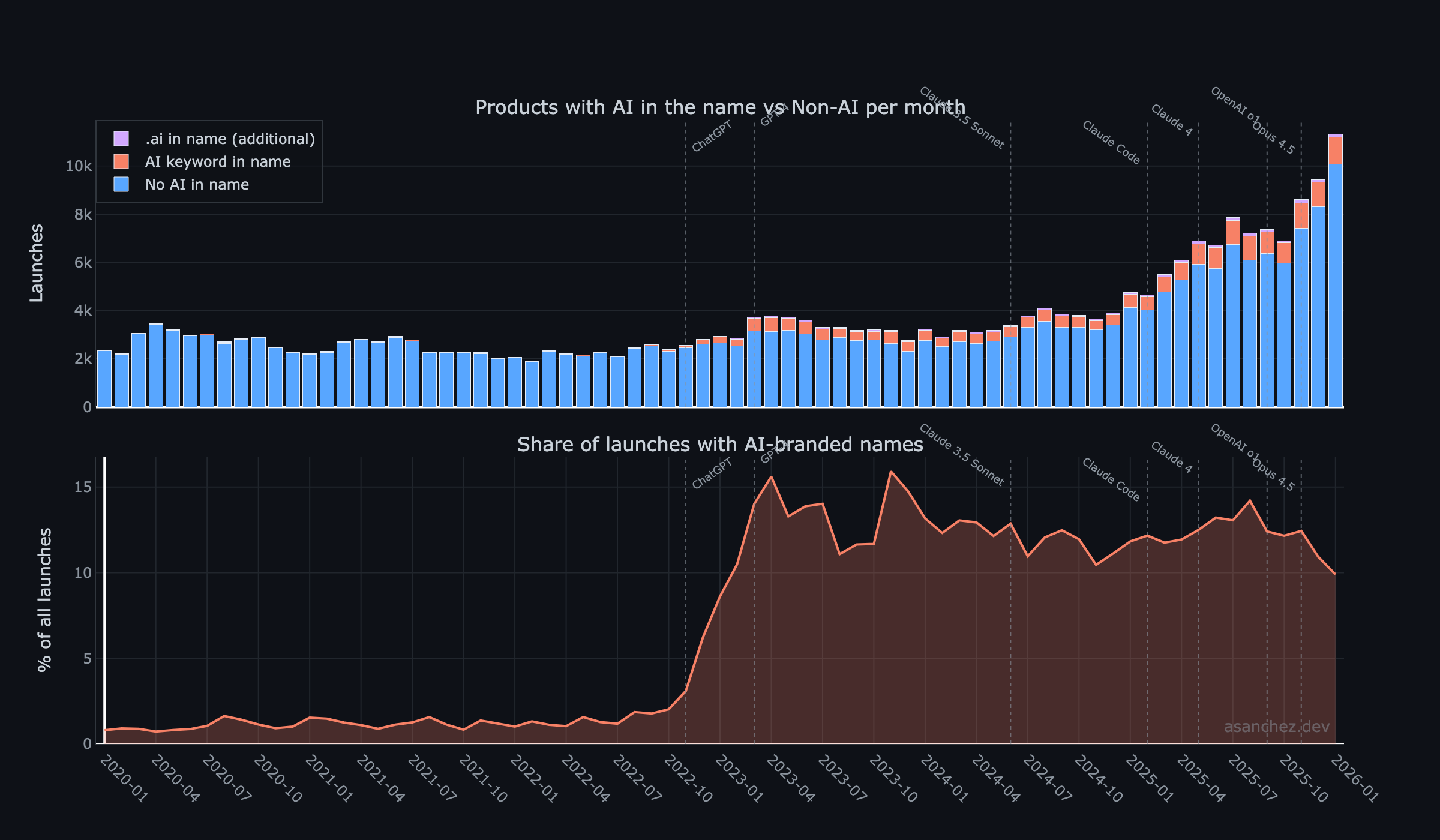

AI in Product Names (Branding)

Beyond counting AI mentions in names and descriptions, it’s worth isolating products that put “AI” directly in their product name, a stronger signal of brand identity.

Key takeaways:

- 9.9% of launches now have AI in their product name, down from 11.8% a year ago.

- Last month: 1,108 AI-branded launches; 122 of those include

.aiin the name. - 22,447 launches have included AI in the product name across the full dataset.

At first glance, ~10% might seem low given the AI hype cycle—you’d expect the label everywhere. But this is actually the normalization thesis in action: early in the AI wave, slapping “AI” in your product name was a differentiation strategy. Now that AI is assumed, the label is becoming redundant, and potentially even a signal of shallow positioning. The products using AI under the hood far outnumber those advertising it in their name.

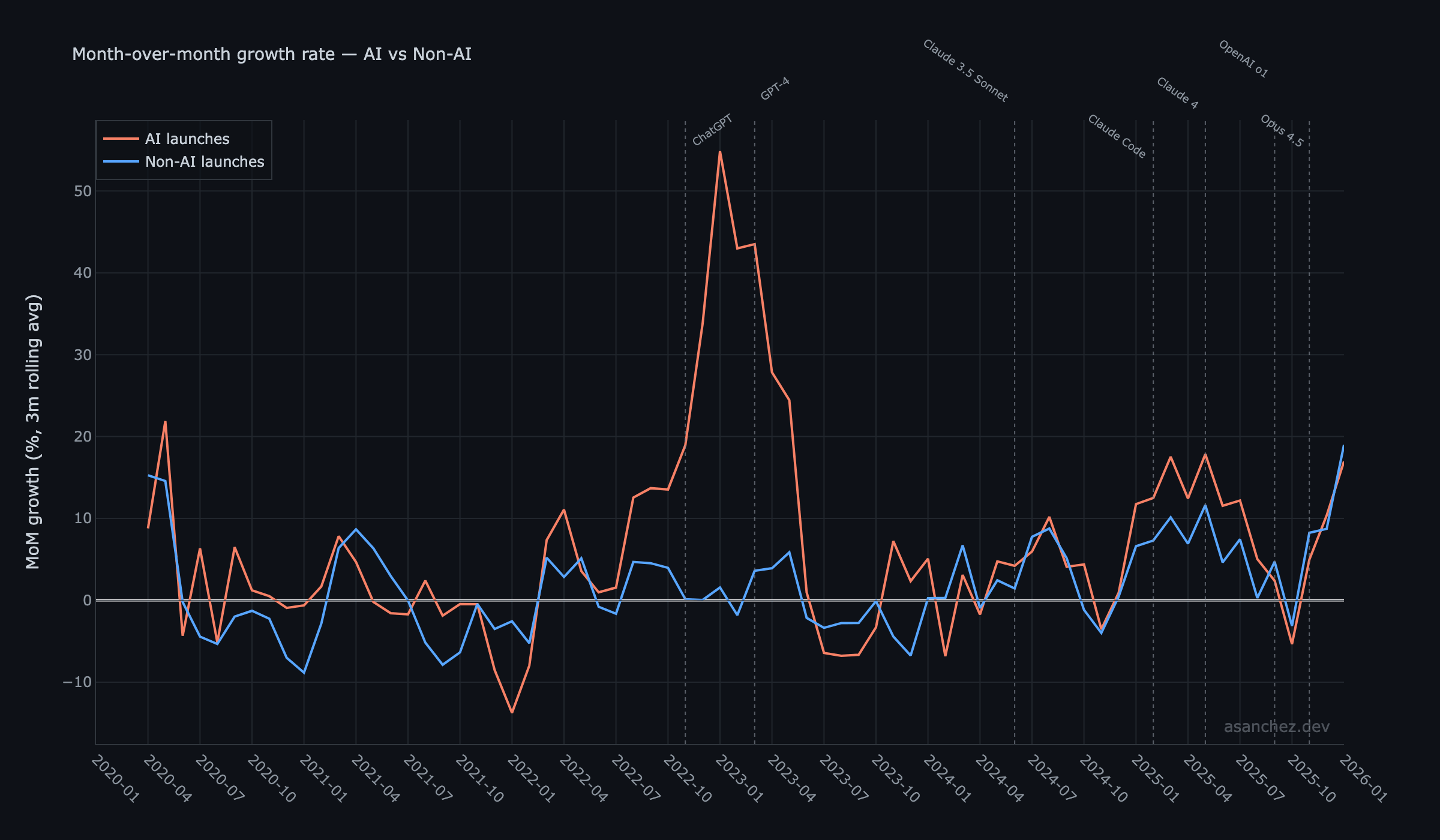

Month-over-Month Growth (Momentum)

To understand momentum, I computed month-over-month (MoM) growth for AI and non-AI launches, then applied a rolling 3-month average to smooth noise.

The initial post-ChatGPT surge is obvious: AI launch growth spikes sharply, then normalizes into cycles. Recently, non-AI has been growing slightly faster on a smoothed basis (about ~1.2pp gap)—though whether this signals resilience or accelerating competition remains an open question.

What stood out

- The spike right after ChatGPT: AI launch growth rate surges sharply.

- Then normalization: after the initial shock, AI growth becomes cyclical rather than “straight up forever”.

- Recent growth (3-month rolling average):

- AI launches: +10.8% MoM

- Non-AI launches: +12.0% MoM

- Non-AI is currently growing faster by ~1.2pp

That last bullet is interesting: non-AI is not shrinking—it’s expanding. But remember: if “AI kills SaaS” means commoditization rather than disappearance, more launches flooding the market could be exactly what that thesis predicts.

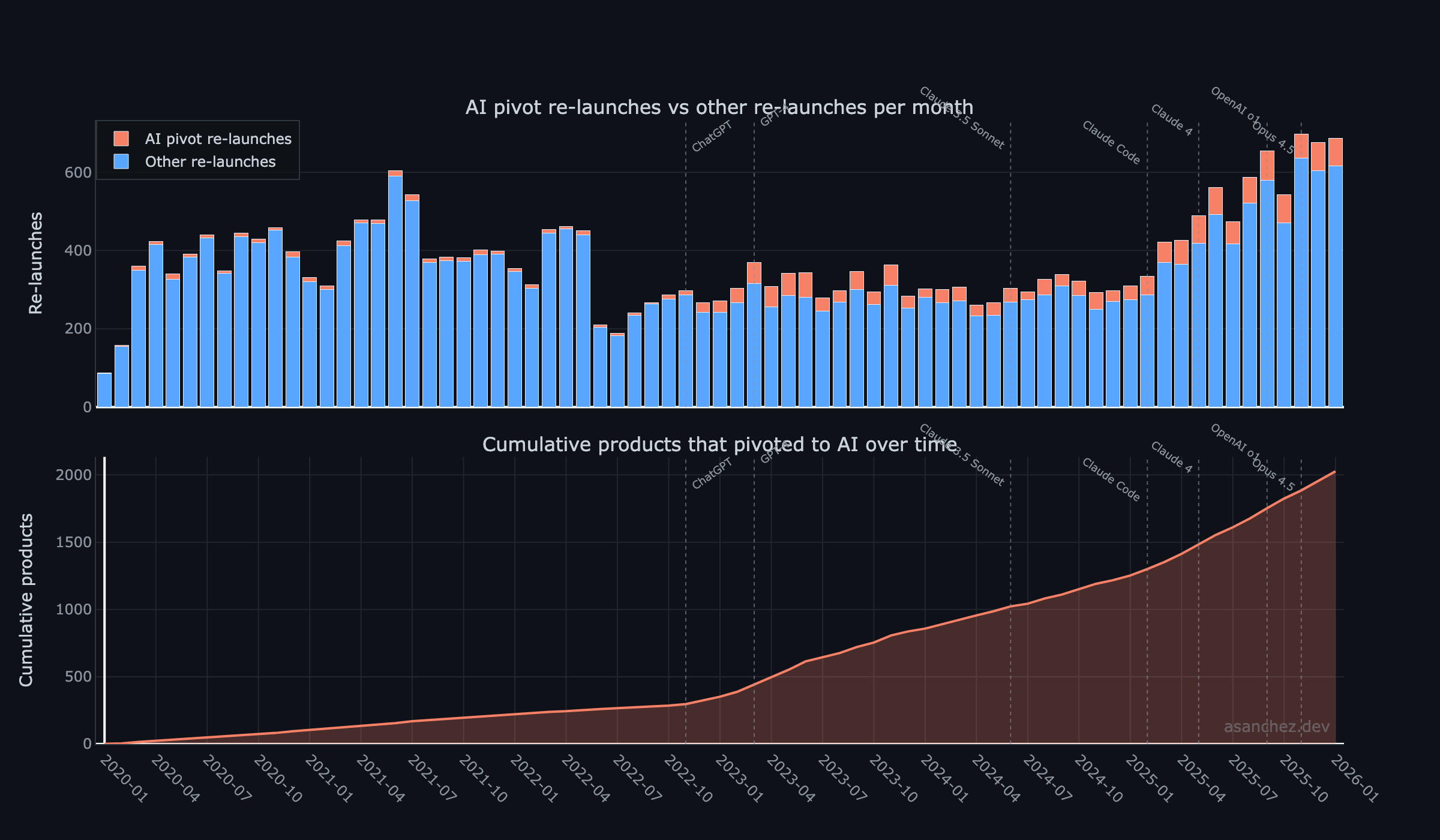

AI Pivots: Legacy Products Relaunching with AI Positioning

Beyond new launches, there’s another signal worth tracking: legacy products returning to Product Hunt with AI at the core of their value proposition.

I identified 2,027 cumulative “AI Positioning Pivots”—products that initially launched with no AI branding but came back later explicitly positioning around AI.

Beyond pivots, looking at overall relaunch patterns reveals an interesting dynamic. To avoid denominator confusion, the table mixes two units of analysis: products (unique products) and launches (launch events).

| Metric | Total | AI | Non-AI | AI % |

|---|---|---|---|---|

| All launches (launch-level, cumulative 2020–2026) | 263,088 | 64,601 | 198,487 | 24.6% |

| Products with 2+ launches (product-level) | 14,870 | 5,367 | 9,503 | 36.1% |

| First launches of relaunched products (launch-level) | 14,870 | 3,340 | 11,530 | 22.5% |

| Re-launch launch events only (2nd, 3rd, …; launch-level) | 27,449 | 6,520 | 20,929 | 23.8% |

(Note: “Products with 2+ launches” and “First launches” show the same total because each relaunched product has exactly one first launch.)

Key takeaways:

- Product-level intensity: AI products average 3.2 launches per product vs 2.7 for non-AI products — among products that relaunch, AI products iterate more aggressively.

- Launch-level mix: AI share in re-launch launch events is 23.8%, slightly below the 24.6% AI share across all launch events. Non-AI therefore contributes more relaunch events in absolute count (20,929 vs 6,520), mainly because the non-AI base is larger.

- 2,027 products made an AI positioning pivot — first launched without AI branding, then re-launched with AI keywords.

One pattern stands out: AI products, once launched, tend to double down with more frequent updates and relaunches. Meanwhile, the non-AI relaunch volume indicates that traditional software products aren’t standing still — they’re actively iterating too, just without the AI branding.

The gap between the 11.5-month median and the 17.0-month average pivot time is revealing. The median tells us half of pivoting products added AI within a year of their original launch. But the average is pulled up by a long tail—some products waited 3+ years before repositioning around AI. This distribution suggests two distinct behaviors: fast followers who jumped quickly, and late adopters who waited until AI became unavoidable.

That split points to two distinct cohorts:

- Fast followers: products that pivoted quickly once ChatGPT made AI mainstream.

- Late adopters: products that waited longer—possibly because AI wasn’t an obvious fit, or because integration required deeper technical work.

Either way, the pivot is institutionalizing. AI isn’t just dominating new launches—it’s pulling existing products back into the spotlight.

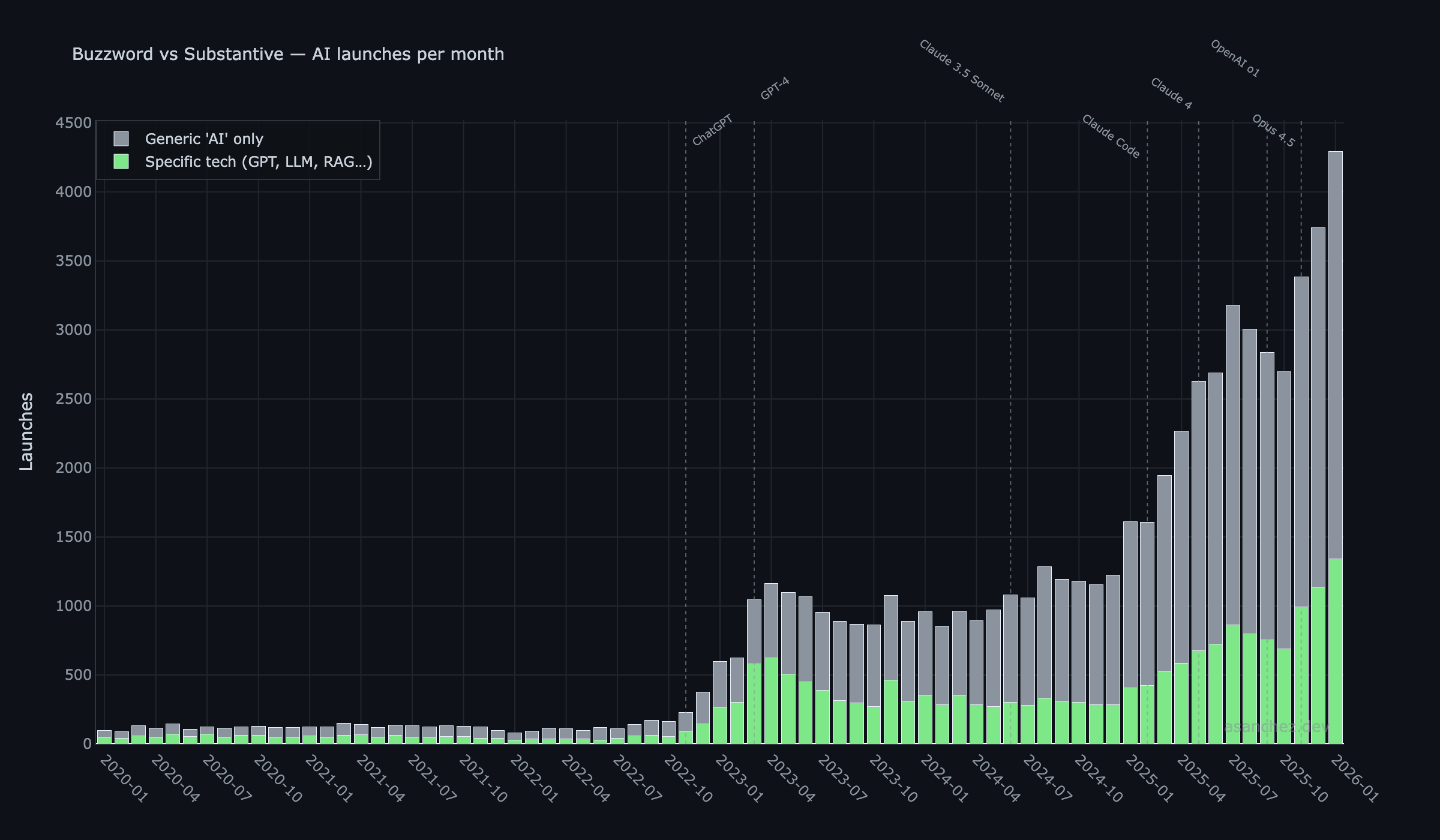

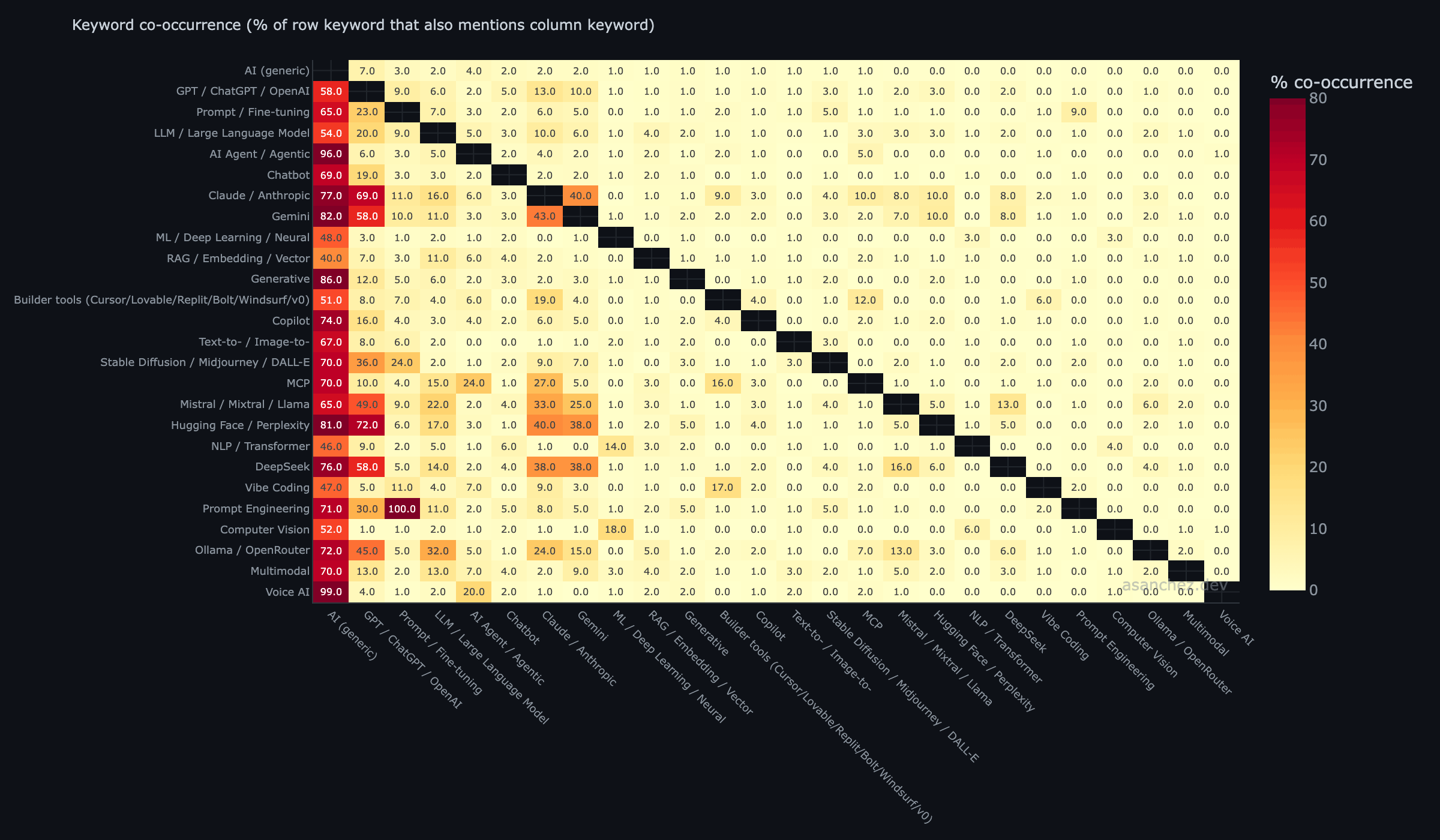

AI Buzzwords vs Substantive Mentions (AI-washing)

Here’s a notable pattern: the data is consistent with increasing “AI washing.”

While the absolute number of launches mentioning specific technologies (GPT, LLM, RAG, etc.) has grown, the share of AI launches with substantive tech mentions has declined sharply:

- March 2023: 55.4% of AI launches mentioned specific tech

- January 2026: 31.2% of AI launches mention specific tech

That means 69% of AI products now use generic “AI” positioning without naming specific models, techniques, or providers. This is consistent with AI-washing, though part of the shift could also reflect simpler copywriting as AI becomes more assumed.

The silver lining: specific keywords are still growing fast in absolute terms, and competition among providers is heating up:

- Gemini: +1214% YoY growth

- Claude / Anthropic: +947% YoY growth

- Prompt / Fine-tuning: +410% YoY growth

(YoY here uses the latest 3-month average vs the same 3 months one year earlier.)

This paints a bifurcated market: a small cohort of technically-specific launches competing on stack depth, surrounded by a growing sea of generic “AI” positioning. Whether the market eventually punishes shallow AI branding remains to be seen—but for now, the buzzword is winning.

AI Normalization: When “AI” Stops Being a Differentiator

The most provocative finding in this report isn’t the growth of AI—it’s the surge of everything else. In our most recent data, non-AI launches grew 12.0% MoM, outpacing AI’s 10.8% growth by 1.2 percentage points.

This suggests we may be approaching a saturation point for AI as a standalone category. In the current window, AI share has mostly oscillated in an observed 38-42% band (peaking at 42.3% in August 2025), which is consistent with an emerging ceiling. But this should be treated as provisional rather than a proven equilibrium until we have a longer stationary window and confidence bounds.

We are entering a “Post-AI” era where AI is assumed rather than advertised. In the latest month, only 1,108 products actually used “AI” in their name or branding, despite thousands more using the tech under the hood.

This raises questions for product strategists: Is “Non-AI” software destined to become a boutique category, or are we simply reaching a point where labeling a product as “AI” is as redundant as labeling it “Software”? And more critically: does this normalization represent maturation—or the early stages of a race to the bottom?

Interpreting the Results

What the data supports confidently:

- AI became a major part of how software products are launched and marketed.

- The “AI wave” is real and clearly visible in time series data.

- Total launch volume increased significantly during the period where AI tools became mainstream.

- Non-AI launches did not collapse—they grew, adding to an increasingly crowded market.

What this data doesn’t prove by itself:

- That AI increased developer productivity (plausible, but not directly measured here).

- That SaaS revenues are shrinking or growing due to AI (needs funding/revenue data).

- That AI launches are “better” or “worse” businesses (needs outcomes).

The short version:

AI changed the launch mix dramatically and coincided with a surge in overall shipping. Whether that surge represents opportunity or commoditization—this data alone can’t say.

Implications (practical)

- “AI” as a differentiator is decaying. Assume buyers expect it by default.

- Distribution + trust matter more if shipping gets cheaper and competition increases.

- Moats shift from features → workflow, data, and switching costs (what’s embedded, not what’s demoed).

FAQs

Does this prove AI increased developer productivity? Not directly. This dataset measures launch behavior and positioning. Productivity claims would need repo activity, team sizes, output per engineer, or comparable proxies.

Is Product Hunt representative of SaaS? Not perfectly. It over-represents launch-driven startups and maker communities — but it’s still a useful proxy for what people are actively shipping and marketing.

Caveats

Product Hunt is not the entire industry. It over-represents launch-driven products, startups, and maker communities.

Product Hunt itself grew during this period. The +139% launch growth cited above is a latest-month YoY figure (2026-01 vs 2025-01). It likely reflects a mix of AI effects and platform effects: Product Hunt may have gained users, improved SEO, and become more mainstream during this window. Some of the “surge” is platform growth, not just ecosystem growth. This is a confounding variable we can’t fully separate.

Keyword tagging has false positives/negatives.

- Some AI products don’t mention AI.

- Some products mention AI lightly for marketing.

“AI-related” includes positioning, not just implementation. That’s intentional for this question (market perception matters), but it’s worth stating explicitly.

Even with those caveats, the trend magnitude is large enough that classification noise is unlikely to erase the overall shape.

Methodology

Here’s exactly how the dataset was built and cleaned — so you can disagree with the method if you want, but not with hidden assumptions.

Dataset

- Source: Product Hunt launches (2020-01 → 2026-01)

- Fields used:

name,description,createdAt(launch timestamp) - Cleaning: spam removal (regex/pattern heuristics + NLP detection + manual whitelist/blacklist curation), then AI-tagging

- Final counts:

- 3,954 spam launches removed

- 263,088 clean launches analyzed

Robustness Snapshot (Growth Metrics)

To make the growth claims less sensitive to any single month, here are baseline and sensitivity cuts from the same cleaned dataset:

| Measure | Total Launches | AI Launches |

|---|---|---|

| Latest-month YoY (2026-01 vs 2025-01) | +139.0% | +166.8% |

| Median monthly YoY, last 12 months (2025-02 → 2026-01) | +97.8% | +151.1% |

| Median monthly YoY excluding 2025-12 and 2026-01 | +94.7% | +143.5% |

| Trailing-12 YoY (sum 2025-02 → 2026-01 vs 2024-02 → 2025-01) | +103.6% | +154.5% |

| Window-aligned sensitivity excluding 2025-12 and 2026-01 (sum 2025-02 → 2025-11 vs 2024-02 → 2024-11) | +94.4% | +146.7% |

The late-2025 / January 2026 spike amplifies headline percentages, but the broader acceleration remains strong across all robustness cuts.

A quick note on what this dataset can (and can’t) answer:

- It’s great for measuring launch behavior and positioning (“are people launching/marketing as AI?”).

- It’s not a direct measurement of developer productivity (for that you’d want repo activity, team sizes, funding, revenue, etc.).

Still, if AI is changing SaaS, you’d expect some visible signature in launch dynamics over time. That’s what we’re looking for here—though it’s worth noting upfront that “destroying SaaS” could mean more launches (everyone can build, more competition, price pressure), not fewer.

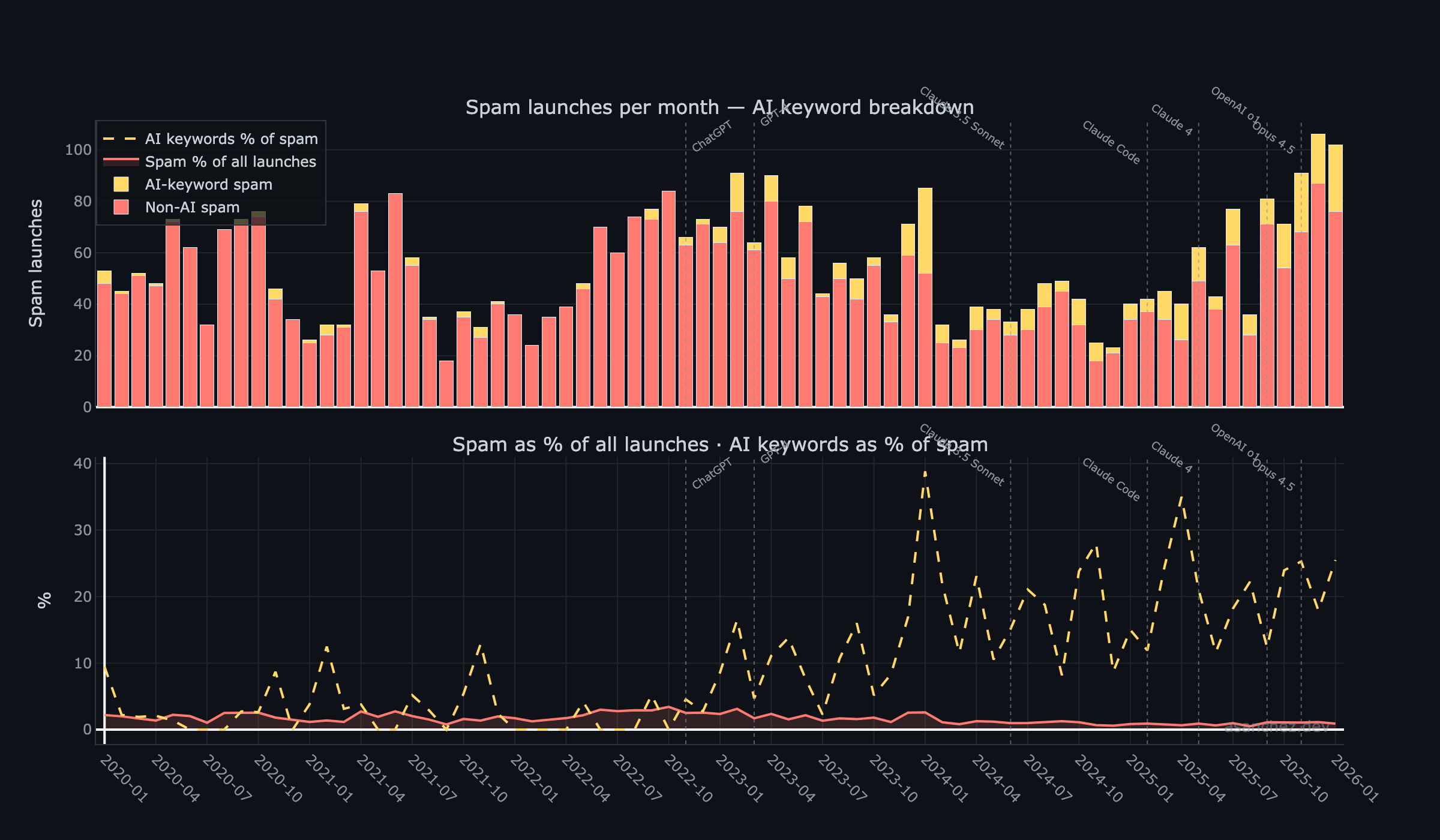

Spam Removal

Product Hunt is curated, but at this scale there is still noise: spammy “launches” that are clearly not real software products.

Before running any analysis, I removed spam using a two-layer approach: automated detection (regex/pattern heuristics first, then NLP spam scoring) followed by manual curation via whitelist/blacklist files.

The regex/pattern-heuristic layer flags a launch as likely spam if it matches any of these signals:

- Pharma/drugs

- Buy/sell language

- Phone number spam

- Gambling

- SEO spam

- Social media scams

- Counterfeit goods

- Health scams

- Empty/minimal descriptions

- Duplicate descriptions

This is intentionally conservative. The automated passes surface candidates, but the final removals are manually curated—so real spam is likely higher, but I’m only removing what’s very likely not legitimate product launches.

After this cleaning pass:

- 3,954 launches removed as spam

- 263,088 launches remain

One notable finding: 10% of spam mentions AI keywords. Spammers recognize “AI” as an attention-grabbing term worth exploiting—a small but telling signal that the hype has reached saturation.

AI Classification

After spam removal, I flag a launch as AI-related if its name or description contains any of the keywords below (case-insensitive).

I’m doing this for two reasons:

- It’s transparent (you can audit or change the rules).

- It captures both AI tech and AI positioning.

Models & providers

AI, GPT, ChatGPT, OpenAI, LLM, Large Language Model, Claude, Anthropic, Gemini, Mistral, Mixtral, Llama, Qwen, DeepSeek, Copilot, Stable Diffusion, Midjourney, DALL-E, Hugging Face, Perplexity, Ollama, OpenRouter

Builder tools

Cursor, Lovable, Replit, Bolt.new, Windsurf, v0

Techniques

Machine Learning, Deep Learning, Neural, Generative, NLP, RAG, Fine-tun, Prompt, Embedding, Vector, Transformer, Computer Vision, MCP, Chatbot

Buzzwords

AI Agent, Agentic, Multimodal, Text-to-, Image-to-, Voice AI, AI Wrapper, Vibe Cod, Prompt Engineering

Classification results (overall):

- AI-related launches: 64,601 / 263,088 (24.6%)

- With specific tech keywords: 20,280

- Generic “AI” only: 44,321

One important implication: a large share of “AI launches” are likely branding-level AI (only generic “AI” / “Artificial Intelligence”, with no mention of specific models/techniques) rather than describing a specific stack. That doesn’t make them irrelevant—if the thesis is “AI disrupts SaaS”, positioning is part of the disruption.

Conclusion

After analyzing 267k launches, here’s what the data actually tells us—and what it doesn’t.

The discourse tends to split into “AI killed SaaS” versus “AI created infinite opportunity.” But this dataset can’t settle that debate. Revenue, churn, pricing power, business outcomes—none of that is visible here. What we can see is launch behavior and positioning. And on that front, only two conclusions hold up:

1. Software is being commoditized

More software is being launched than ever before—AI and non-AI alike. Total launch volume nearly doubled year-over-year. Non-AI launches didn’t collapse; they surged alongside AI products.

The simplest explanation: AI has made building and launching software dramatically easier. Tools like Claude Code, Cursor, Lovable, and the broader ecosystem of AI-assisted development have lowered the barrier to shipping for developers and non-developers alike. More people can build. More people are building. The result is a flood of products competing for attention in an increasingly crowded market.

Whether this is good (democratization, more innovation) or bad (race to the bottom, unsustainable competition) is a business question this data can’t answer. But the commoditization signal is clear: software is becoming easier to create, and the market is responding with volume.

A personal note: As a senior developer and system admin, AI has made me several times more productive than I was before. Depending on the project, I can now do the work of 2–3 developers—and more importantly, I can create things I would never have dared attempt before: logos, images, translations, marketing copy.

For example, I built and launched Kasusknacker, an app for practicing German grammar, in a single month—on my spare time. AI assisted every step: coding, design, logo, images, and translating over 30,000 exercises into 6 languages. That translation work alone would have previously required professional translators, weeks of effort, and a budget I didn’t have. A year ago, this entire project would have needed a small team and months of coordination. Now it’s a side project.

This is what commoditization looks like from the inside: not “AI replacing developers,” but developers (and non-developers) shipping at a pace that was previously impossible.

2. Software is incorporating AI—or remarketing as AI

AI went from ~5% of launches pre-ChatGPT to ~40% today. But the nature of that growth is telling:

- 69% of AI-positioned launches use generic “AI” branding without mentioning specific models, techniques, or providers. This share has grown over time.

- 2,027 products pivoted to AI positioning—products that originally launched without AI branding, then relaunched with it.

- AI in product names peaked and is now declining (from 11.8% to 9.9% YoY), even as AI mentions in descriptions grow.

This pattern is consistent with two overlapping phenomena: genuine AI integration becoming table stakes, and opportunistic AI-washing as a marketing tactic. The data can’t distinguish between products that truly rebuilt around AI versus those that added a chatbot and updated their copy. Both show up the same way in launch descriptions.

What the data doesn’t say

This analysis cannot tell you:

- Whether AI products are more successful than non-AI products

- Whether developer productivity actually increased

- Whether SaaS revenue or margins are improving or collapsing

- Whether the AI wave is sustainable or a bubble

These would require funding data, revenue metrics, churn rates, and longitudinal business outcomes—none of which are captured in Product Hunt launches.

The honest summary

Software is being commoditized. More people are launching more products than ever before. This is almost certainly because AI has made building software easier than it’s ever been—for developers and non-developers alike.

Software is converging on AI. Whether through genuine integration or marketing repositioning, the industry is rapidly standardizing around AI as an expected feature rather than a differentiator.

Everything beyond these two observations—whether this is good or bad for founders, whether SaaS is dying or thriving, whether AI products will win or lose—requires data this analysis doesn’t have. The launch volume tells us something changed. It doesn’t tell us who wins.